If you are a business holder having a dedicated employee, probably one of the biggest expenses you need to manage is paying employee wages. This part of payroll management is quite a time consuming and challenging. Fortunately, running QuickBooks services for Payroll can offer you help in the right direction. As an employer, another major thing you must take care of is cumulative year-to-date (YTD). This is a major payroll expense. In this post, we are going to discover a number of important things about YTD payroll including what it is, how it affects your business, and how to adjust YTD payroll in the QuickBooks online version.

So let’s get started….

What is the year-to-date payroll?

Year-to-date payroll depicts the total amount of capital your company has expended on payroll from the beginning of the fiscal year, up to the latest payroll date. For the purpose of calculating YTD, the gross income of employees which is obtained after removing taxes and other deductions from total income is considered.

YTD may also comprise payment made to freelancers or independent contractors. Although they are self-employed individuals recruited for a particular task, they must be essentially included in your company YTD payroll.

When viewed from the employees’ perspective, YTD payroll depicts their gross income. While for businesses it depicts cumulative earrings of its all employees.

What is the importance of YTD in payroll for your company?

The Year-to-date payroll provides an effective means for companies to compare their employees’ payroll expenses against the total annual budget allocated for such tasks. Having access to this handy comparison chart, businesses are able to easily gauge their payroll expenses against the total business expenses.

Thus, YTD serves as a parameter through which you can track your company’s performance and find out whether you are working as per your set outcomes or not. This plays an imperative role in helping you make decisions on hiring or budget reductions. Besides, year-to-date payroll also assists you with finding out potential tax liabilities

Reasons Why You May Need to Adjust YTD Payroll in QuickBooks Online

On several occasions, you may find a need to adjust your YTD payroll. It may either require additions or deductions based on applicable cause, which include:

Use of inaccurate tax tracking type in payroll item.

Accurate tax tracking type but error alternation in checkmarks by the customer, resulting in an error in tax and income base calculation.

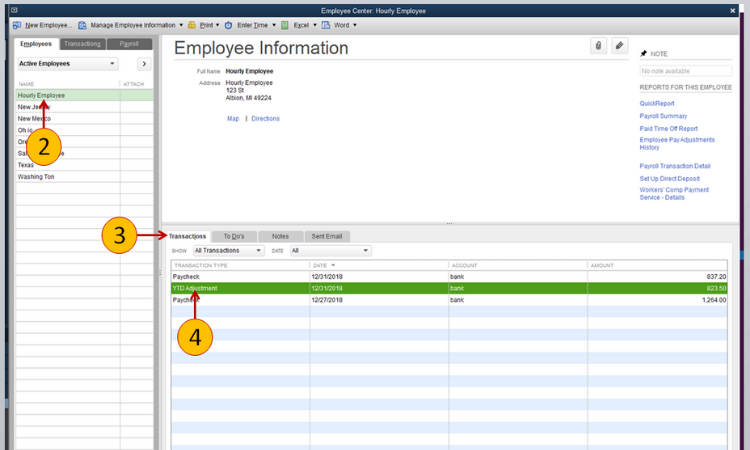

Steps To Adjust Year-to-Date (YTD) Payroll in QuickBooks Online

Your next is to adjust or update the Year-to-date payroll in QuickBooks Online. For this follow the steps given below:

1. Open QuickBooks Online.

2. In the Help menu and press on About QuickBooks.

3. Next, use short-key combination Ctrl +Alt + Y or Ctrl +Shift +Y. This will open the window of Setup YTD Amounts.

4. Then, in the Set Up YTD Amounts window, identify documents for which you need to enter YTD history for. Click Next and proceed.

5. After this, you will be prompted to enter the date to adjust your YTD entries in accounts. Enter the approximate date of your first payroll in both boxes and then hit Next.

6. If you encounter any problem while entering your current quarter YTD, then go for a later date for adjustment.

7. To fill YTD summaries double-click on each employee and click on the Next.

8. After you have completed all YTD entries, tap on the Next button to shut Employee Summary Information Window.

9. Finally, click on the Finish button for process completion.

The Parting Words…

I hope this easy-to-understand helps you adjust your YTD payroll conveniently. This QuickBooks functionality will enable you to make revisions without any fuss. With QuickBooks managing employee information and expenses is very clear, simple, and precise. If any of these steps confuse you, look for the QuickBooks tutorials. The QuickBooks team will help you accomplish your year-to-date payroll with ease. Swiftly and quickly they will enable you to get back to your business. Try the QuickBooks Payroll feature today!

Leave a reply

Your email address will not be published. required fields are marked *

{{comments.length}} Comments

{{ comment.name }}

{{comment.datetime}} Reply{{comment.message}}

{{ comment.name }}

{{comment.datetime}}{{comment.message}}