If you regularly trade energy markets you know the risks involved. The energy commodities markets, for example, Crude Oil or Natural Gas have gone through huge price swings over the last ten years. WTI Crude Oil rose to $147 in July 2008 but fell to $32 the same year. Later, prices shot up to $115, and then fell again to $26, and lately, prices are range-bound between $50 to$56. Whether you are an individual trader or a company that trades energy commodities you know the risk involved with a bad call. Nonetheless, by relying on an accurate energy price forecast, the volatility of prices can profitable.

Today’s’ write-up is about the Kase Commentaries on Natural Gas and Crude Oil an energy forecast, and how it can prove helpful in your trade decisions.

Decipher Market Trends

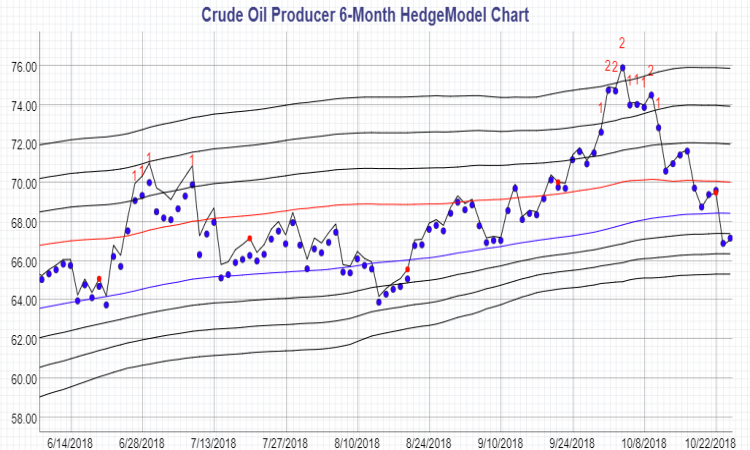

A key advantage of an energy price forecast is you get information on the most likely direction of the market. The analysis done in the forecast allows you to decipher market mood and the way it will probably turn shortly. The energy forecast helps you to get a real picture of the market and allows you to make informed decisions.

These price forecasts provide an understanding of the direction of the market, but also the strength of the trend, support and resistance targets, and probabilities for meeting and holding those levels. This leads to effective trading decisions.

Trends and Corrections Are Separate

There is a variance between trends and corrections in the energy commodities markets. Since these markets are volatile, corrections occur often. So, the key is to determine the major trends, and whether those trends have ended, and if the market is in a corrective phase. With this information you can decide on the best possible strategy to use, what time frame to watch, and how much risk to take.

Figure Market Strength

You may find predictions on energy markets given by experts, but they just cannot predict the strength of the market. Sometimes, experts don’t compare and contrast historical market data to current data. Here is why scientifically and mathematically analyzed data can prove to be more effective. The technical analysis based energy forecasts can give a much accurate prediction about the direction of the market, and likely strength of the direction as well, based on the comparison to historical prices

Figure Market Direction

Figuring the market direction is perhaps the hardest if not the most important in trading. Energy forecast given by a seasoned market technician and forecaster can tell you if the market is going up or down, but also if it is in a sideways corrective phase. This forecast will play a significant role in helping you make correct trade decisions.

Avail One-on-One Support

If you choose to subscribe to the Kase Commentaries, you can expect to get their one-on-one support. Suitable for both novice and veteran traders alike trading the energy commodities market. Kase and Company will work with you and help you tailor strategies to meet your goals.

Conclusion

To sum it up, an accurate energy forecast offers a host of benefits and helps you maximize your returns, and mitigate risks in the volatile market situations. Overall, these energy price forecasts, natural gas, and crude oil forecasts are helping both individuals and organizations involved in energy trading.

Leave a reply

Your email address will not be published. required fields are marked *

{{comments.length}} Comments

{{ comment.name }}

{{comment.datetime}} Reply{{comment.message}}

{{ comment.name }}

{{comment.datetime}}{{comment.message}}